Soft Power Geopolitics: Why Moscow’s Tourism Future Rests on China

Moscow is strategically refocusing its tourism efforts on China, resulting in an 83% surge in bilateral visits in 2025.

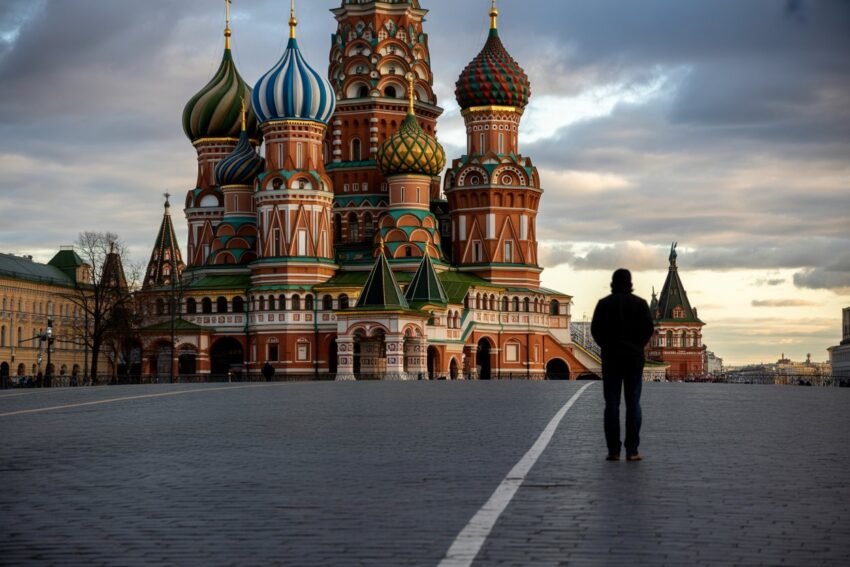

The heart of Moscow is undergoing a subtle but profound transformation, not just for aesthetic reasons, but for strategic ones. What looks like a simple push for more tourists is, in reality, a carefully calculated move in the geopolitical chess game between Russia and the West. With traditional European and American tourist flows diminished, the Russian capital is now firmly and explicitly focusing its energy—and its soft power—on China.

This shift is more than just economic triage; it represents a fundamental reorientation of Russia’s cultural and commercial priorities, viewing tourism as a crucial component of the deepening Sino-Russian alliance. The message is clear: Moscow is open for business, and the primary audience is the Chinese traveler.

The New Geopolitical Calculus of Tourism

For decades, Moscow and St. Petersburg relied heavily on tourists from the U.S. and Europe. However, geopolitical friction has curtailed these traditional flows. The response from Russian authorities, particularly in Moscow, has been an aggressive and systematic pivot toward the East. This strategic move leverages the massive, wealthy, and eager Chinese travel market to fill the gap and, more importantly, to foster deeper, people-to-people connections.

This isn’t just about making money; it’s about “soft power.” By customizing the urban environment and the travel experience for Chinese visitors, Moscow is subtly reinforcing its strategic partnership with Beijing on a cultural and popular level. A warm welcome for Chinese tourists helps solidify the political and economic bonds between the two nations.

Early Signs of the Pivot:

The effort is already paying significant dividends. Data suggests a strong and immediate response to Moscow’s new focus:

- Soaring Numbers: The tourist flow between Moscow and Beijing alone has reportedly increased by a dramatic 83% in the first five months of 2025.

- China as Top Source: China has re-emerged as Russia’s top source of inbound tourism, with hundreds of thousands of Chinese travelers visiting in early 2025 alone. This trend is expected to continue, with Russian industry leaders forecasting over 2 million trips by Russian tourists to China in 2025, buoyed by mutual visa-free policies.

- Infrastructure Adaptation: Moscow’s efforts go beyond simple marketing. The city is actively adapting its infrastructure, services, and cultural offerings to serve the Chinese market better.

Moscow’s Tourist Makeover: Tailoring the Experience

Russia is implementing practical changes designed to make the Chinese traveler feel welcome and understood. This involves a comprehensive review of the entire tourism value chain:

Language and Communication: A key focus is tackling the chronic shortage of Mandarin-speaking guides. While new laws aim to certify more Russian guides, the demand far outstrips supply. Efforts are underway to increase signage, museum descriptions, and public transportation information in Mandarin.

Payment Systems: Recognizing that Chinese travelers rely heavily on digital payment methods not common in Russia, Moscow is working to ensure greater compatibility and acceptance of Chinese mobile payment systems in hotels, shops, and restaurants.

Bilateral Ease of Travel: The mutual visa-free travel program for organized tour groups has been a game-changer.13 Both countries are focused on strengthening this framework, which facilitates large-scale organized travel and reduces bureaucratic hurdles. The recent trial visa-free policy introduced by China for Russian citizens holding ordinary passports further cements this reciprocal relationship.14

Targeted Marketing: The messaging is tailored to appeal directly to Chinese cultural interests, potentially highlighting historical sites relevant to shared Soviet-era history or promoting luxurious, high-end shopping experiences, for which Chinese tourists are renowned.

The Hidden Challenge: The Cost of a Cheap Trip

While the official numbers are celebratory, the massive influx of budget-conscious Chinese tour groups has created tension within the Russian tourism sector.

- Bargain Tourism: Many Chinese tour agencies market Russia as an extremely bargain-friendly destination, offering week-long packages at shockingly low prices (sometimes under $500, including flights).

- The Spend Gap: These low-cost tours depend on tourists making substantial purchases once they arrive. However, there are reports that some groups are focused less on conventional tourist spending and more on informal commercial activity, such as bringing in electronics to resell.18

- Infrastructure Strain: In some regions, particularly the Russian Far East, the surge in visitors has overwhelmed local infrastructure, leading to shortages of affordable transportation and hotel rooms. The tourism infrastructure designed for Western visitors often doesn’t align with the needs of high-volume, cost-sensitive Asian tour groups.

This scenario presents Moscow with a critical balancing act: how to harness the geopolitical benefits of the Chinese tourism boom while ensuring the domestic tourism industry remains profitable, professional, and sustainable. The city must move beyond simply attracting numbers to securing high-value visitors who contribute meaningfully to the local economy.

The transformation of Moscow’s tourism sector is a striking illustration of how global politics directly impacts local economies. By dedicating itself to the Chinese traveler, Russia is not merely seeking tourist revenue; it is intentionally weaving its cultural and economic future closer to Beijing’s, one tour group at a time. The monuments remain the same, but the language on the placards—and the geopolitical orientation of the nation—is undeniably changing.

The post Soft Power Geopolitics: Why Moscow’s Tourism Future Rests on China appeared first on Travel and Tour World

Comments and Responses

Please login. Only community members can comment.